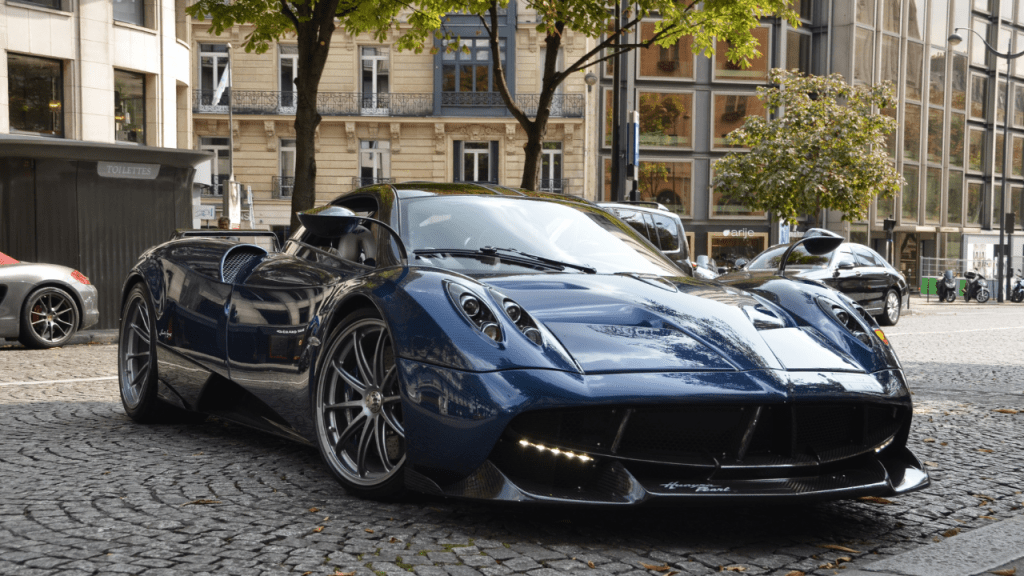

Many things in life that look impressive or fun have hidden costs and challenges. Buying a really expensive car is only part of the expense of owning one. Maintenance, insurance, and storage can end up costing you even more in the long run.

Welcome to Topic Thursday, where we discuss a specific topic related to business, finance, or life in general. Today we’re going to explore the power of smart investment.

Owning a home can be one of the less glamorous investments. But like I touched on earlier, it’s almost always a much better one than a fast car. Sure, sports cars are impressive, and something like a new Mustang would definitely turn some heads. But cars are notoriously bad investments.

Most people don’t typically purchase vehicles to retain their original value. Most people buy cars to drive them. That usage reduces the perceived value of the car, but it obviously does what it was bought to do; aid in travel. In this way, even though a new car “loses value” immediately after it’s sold and driven off the lot, it’s still quite valuable, even after being used for years.

How A Used Car Can Be A Good Investment

New cars usually have obvious aesthetic appeal. There’s no way a previous owner could’ve burned the upholstery with cigarettes or thrown up in the backseat, either. When you’re the first owner of a brand new car, you get to burn it with your own cigarettes. You get to throw up in the backseat.

As a doctor, I don’t recommend you do either of these things. And as a financial mentor, I couldn’t either. Smoking kills milions of people every year, and you won’t be able to sell the car for as much.

But keeping a car for the utility it grants, even while diminishing the market value, can be part of a sound investment strategy.

Insurance As An Investment

We’ve already talked a little about how real estate is a great way to create sound long-term investments. But every real-estate investment isn’t a good one. it’s often just as possible to lose millions of dollars in real estate as it is to gain fortunes. So many factors go into succeeding in each of your ventures that it would take me months to cover them all, but next, I’m going to show you a big one to look out for.

Depending on where you’re looking to purchase property, certain restriction may apply to whether you’ll be able to insure your home. Although insurance policies in every state in the U.S. was once a given not long ago, recently certain insurers have started to exclude certain states. Florida, whose governor’s mansion was just damaged in one of the recent hurricanes churning through the gulf this season, was just dropped by Allstate.

To top that off, FEMA also revised their coverage policies due to lack of funding, possible leaving Florida homeowners to foot the bill of previously covered disasters. If you’re thinking of purchasing a property, make sure that you know the local laws, regulations, and coverages before commitment.

Of course, there are all kinds of insurance. Some of them require a premium payment every month that you might never see again. Others provide the infrastructure to be your own bank. Are you ready to leverage insurance to unlock your financial freedom? Contact my team to schedule a 1-on-1 with me today!

Leave a comment